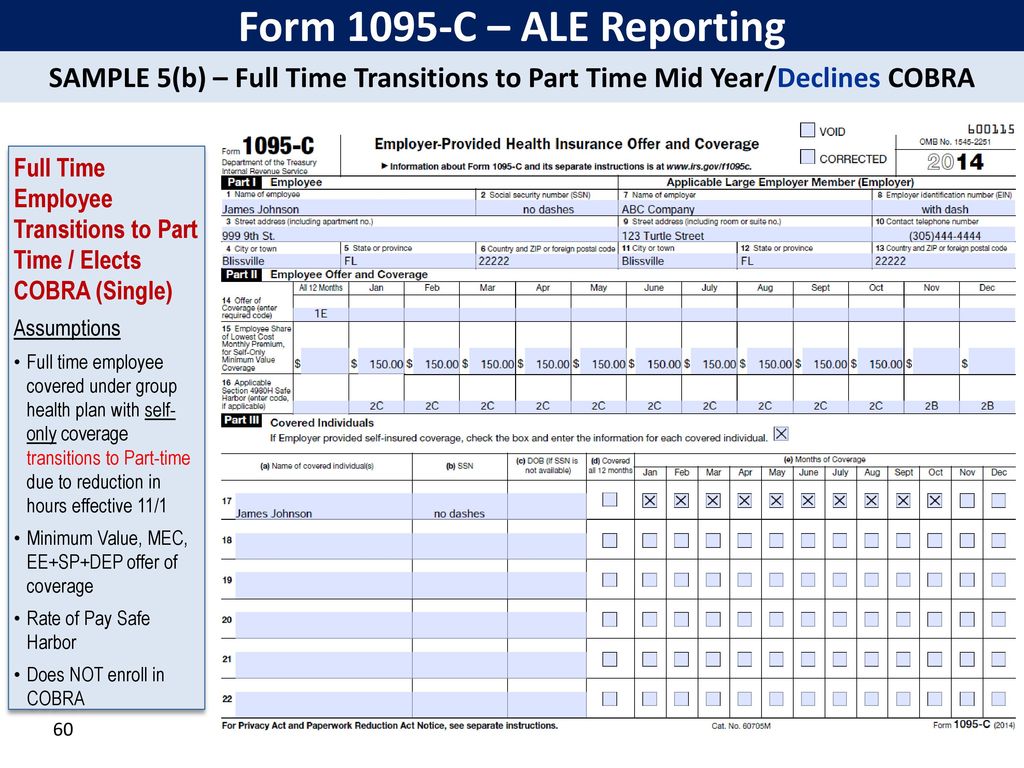

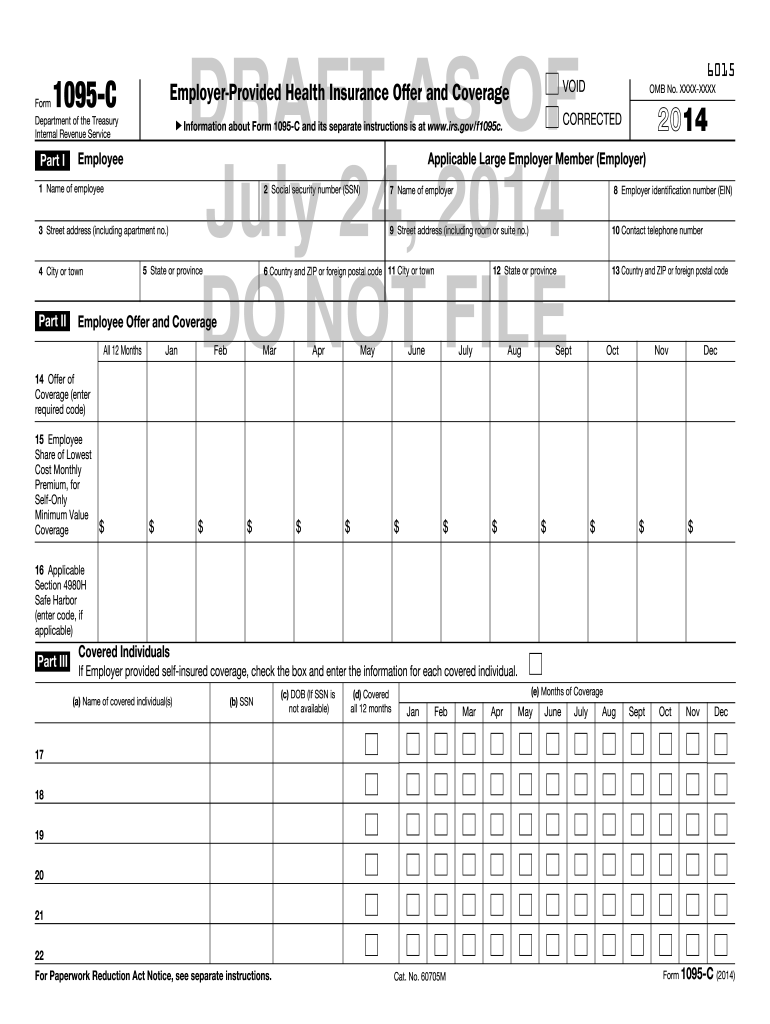

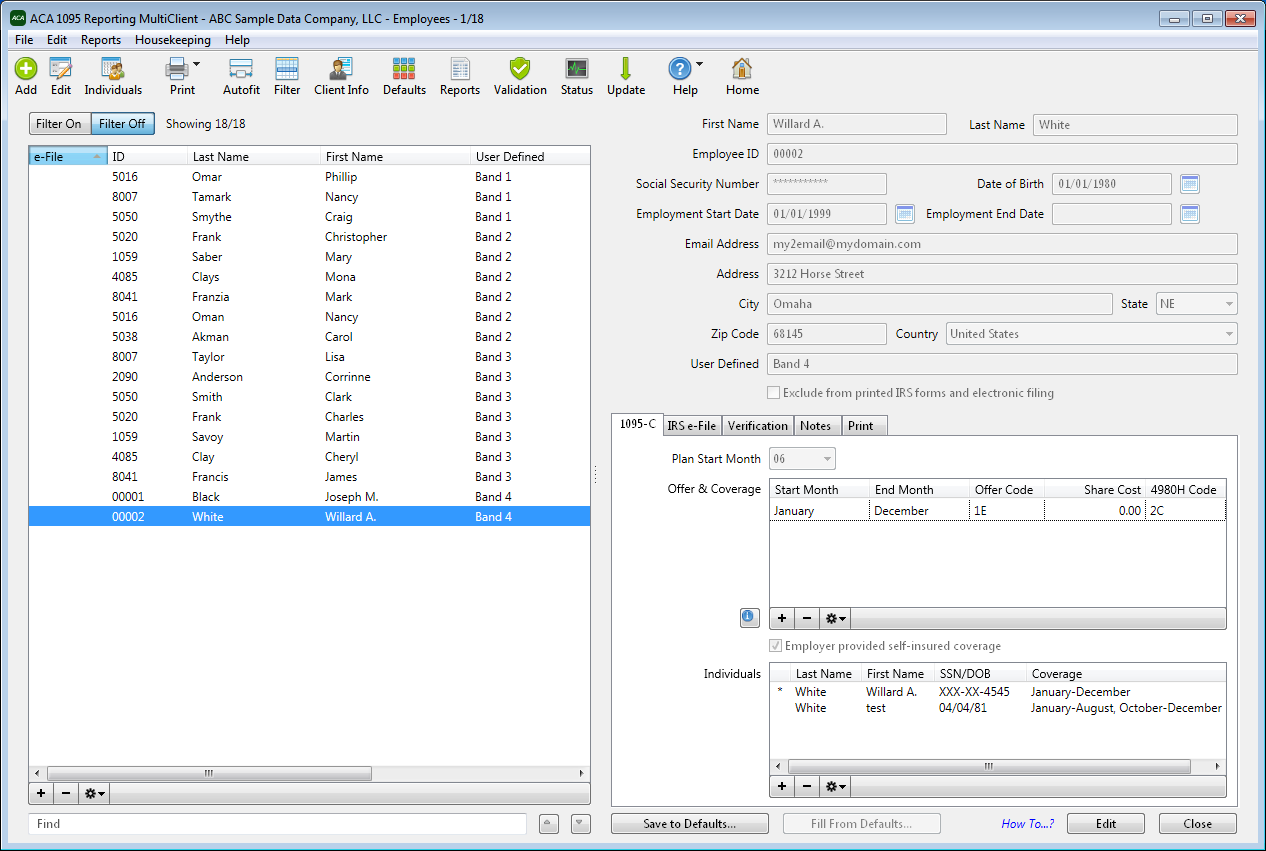

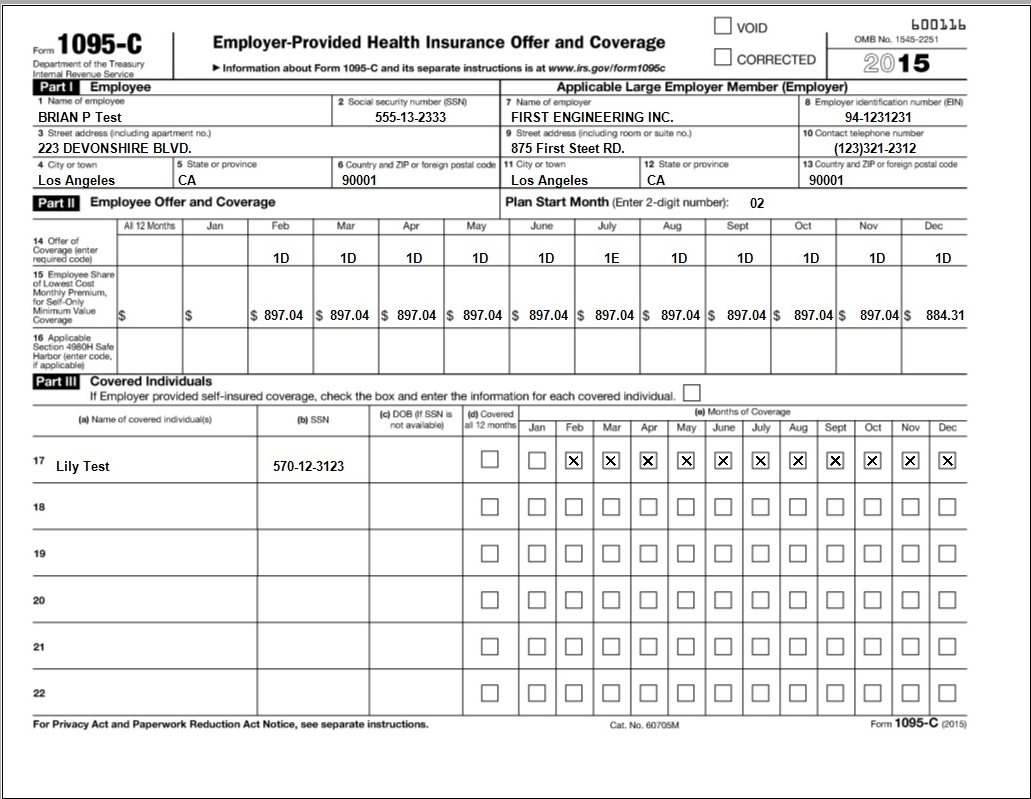

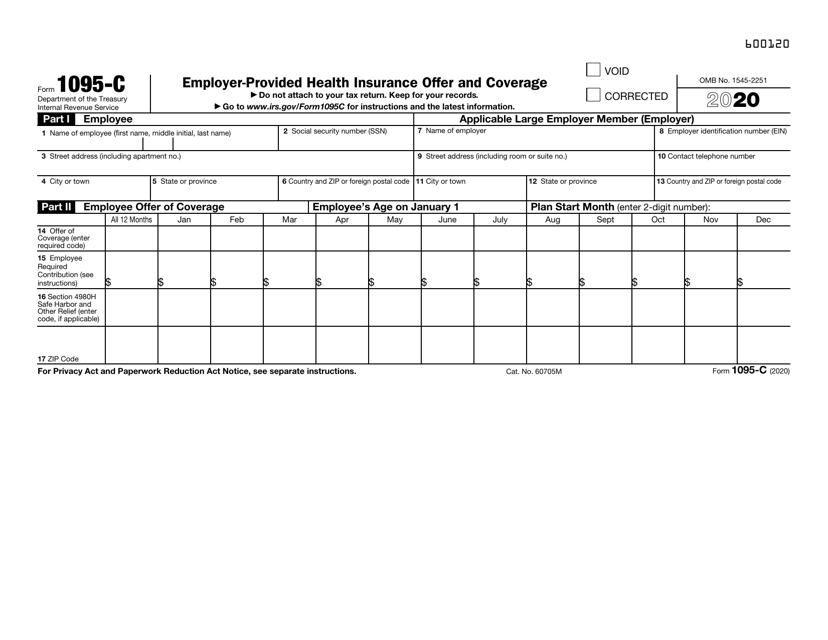

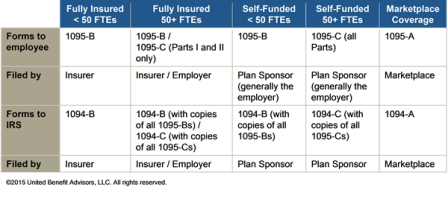

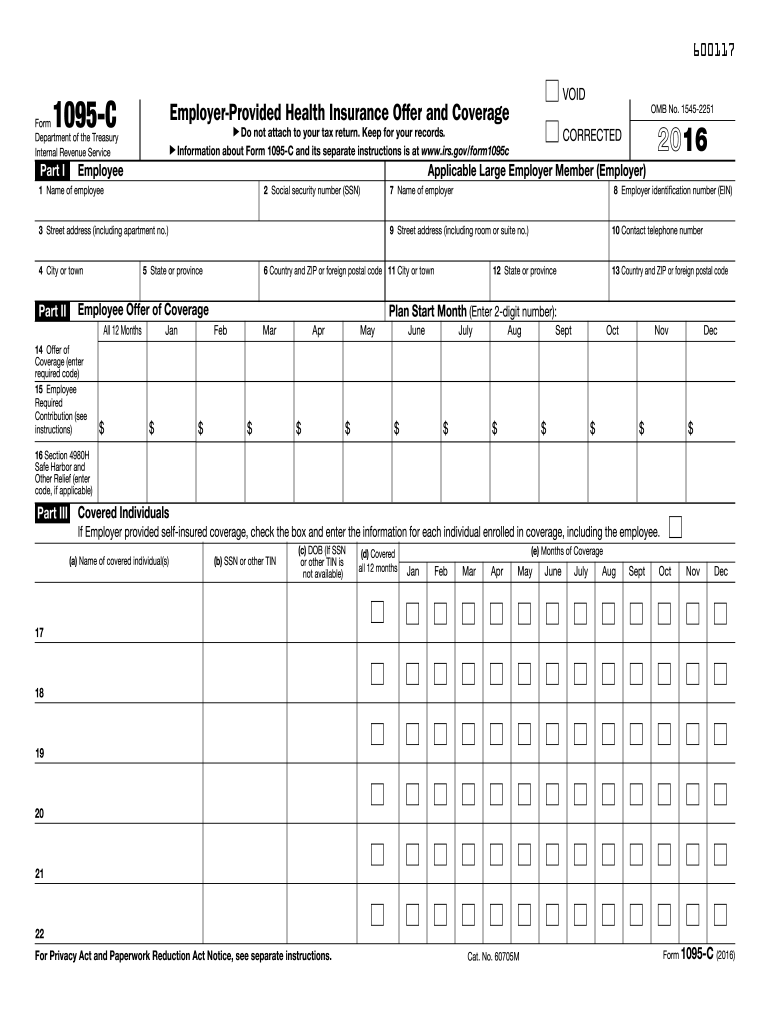

FILLINGOUT FORM 1095C PART II FOR ACA FULLTIME EMPLOYEES Plan Start Month – This box is optional for 16 If you wish to complete it, enter the twodigit number (01 through 12) for the calendar month during which your plan year begins Line 14 – Offer of Coverage79 80 If the answer is Yes, then this will be your authoritative transmittal and you have to go beyond Line 19 (and Part I) 80 81Jan 18, 15 · 1095C forms are filed by large employers If they are selffunded, they just fill out all sections of 1095C If they are fully insured, they get a 1095B from the insurer and fill out Sections I and II of 1095C

How To Fill Out Forms 1094 C 1095 C Employer Health Coverage Youtube

1095-c sample filled out

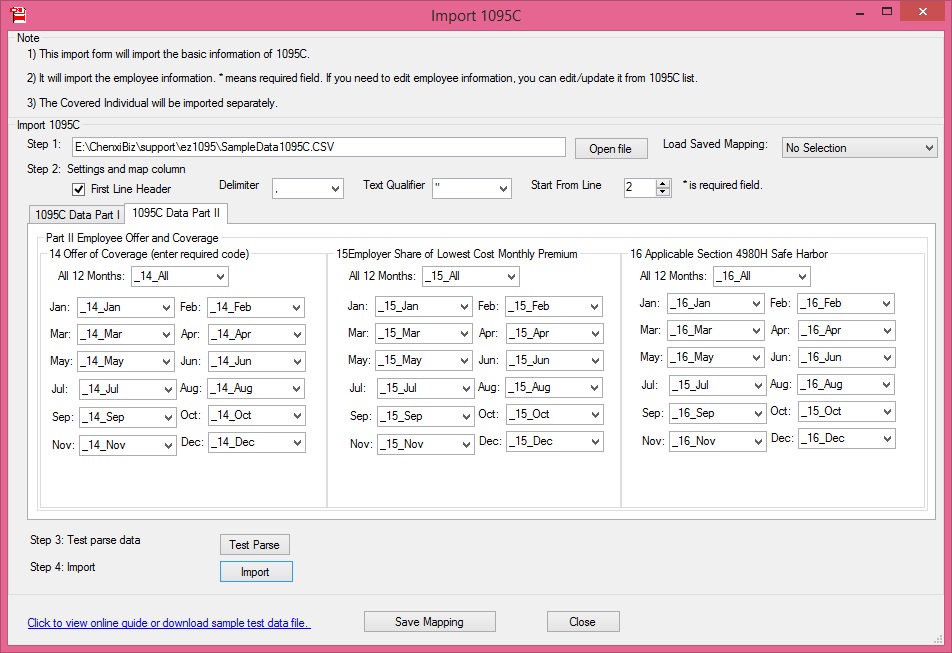

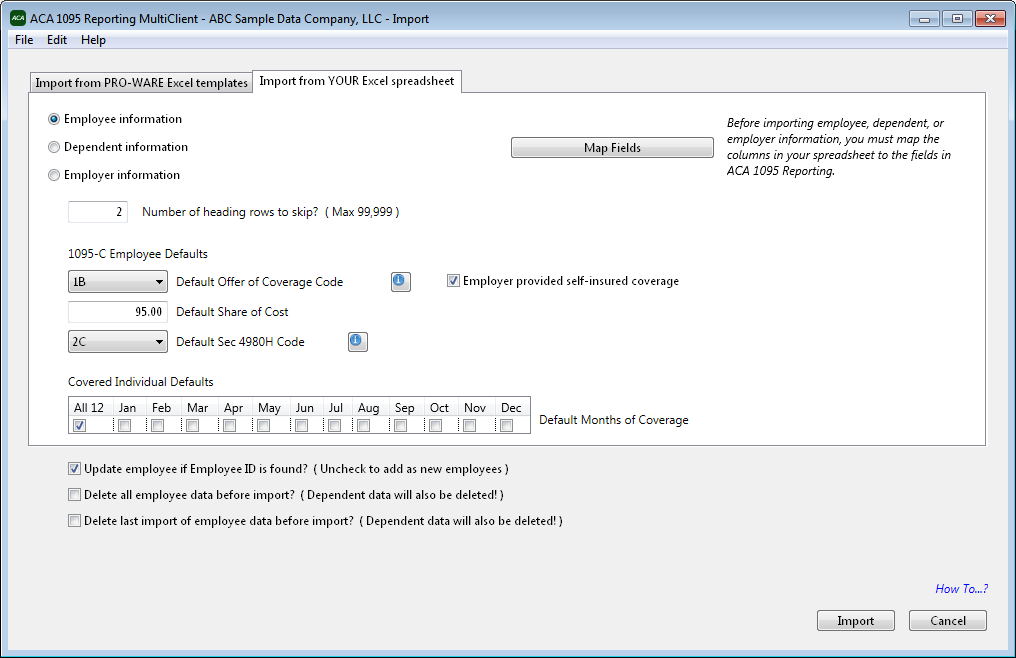

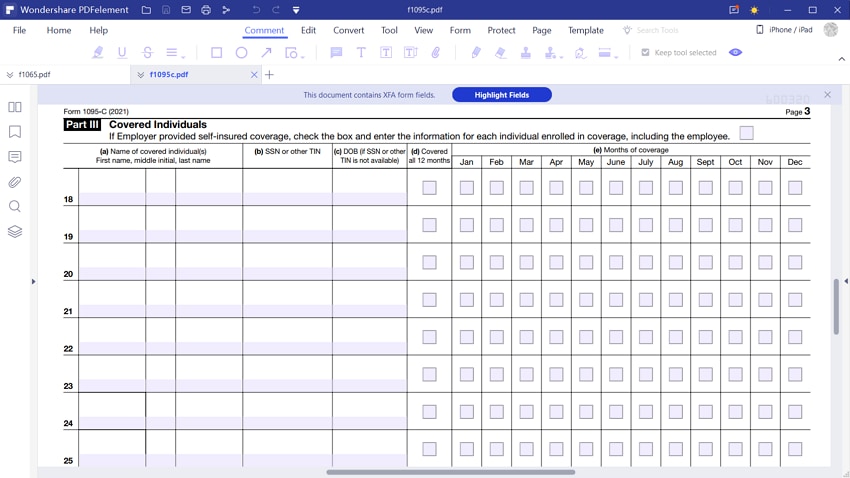

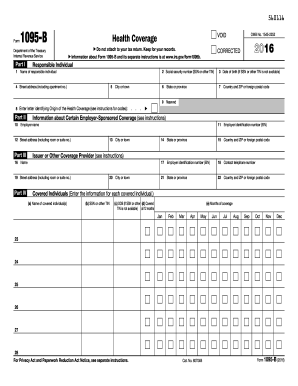

1095-c sample filled out-Note that substitute forms may be used, but the substitute forms must include all of the information required by Forms 1094C and 1095C and must satisfy all of the IRS's form and content requirements Forms 1094B and 1095B are to be used by a small selfinsured employer that is not an ALE for Section 6055 purposesCreating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

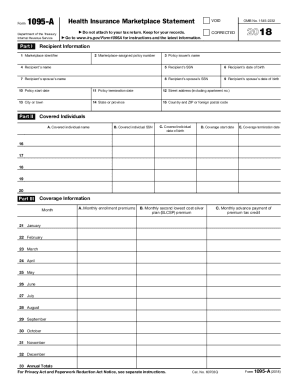

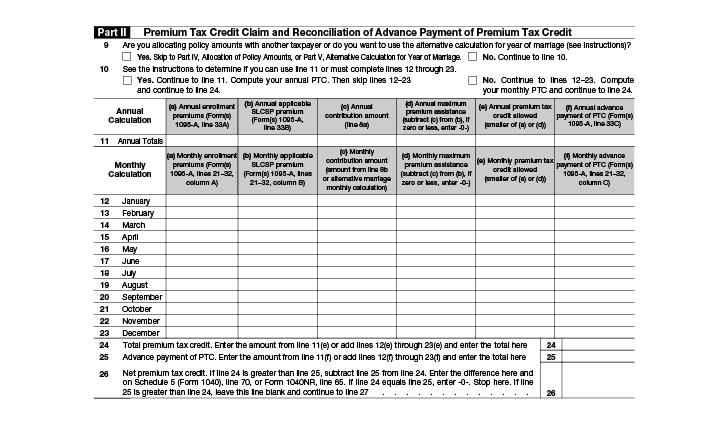

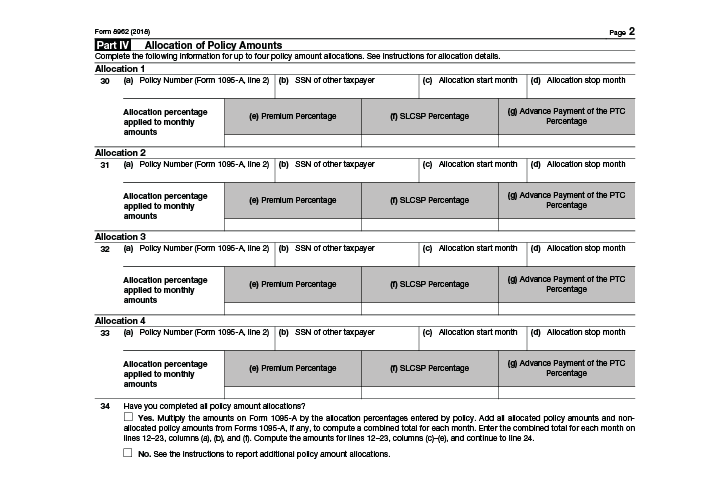

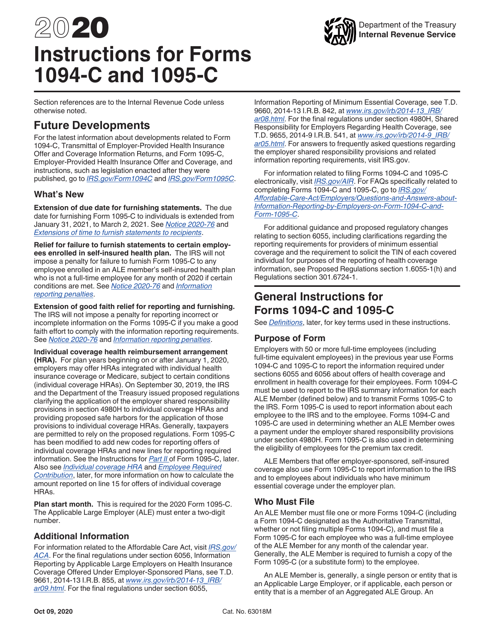

The IRS additionally issued Form 1095C, EmployerProvided Health Insurance Offer and Coverage, to assist ALEs in meeting the reporting requirement under Code § 6056 If the employer's plans are selffunded, the employer also will use the same form, Form 1095C, to meet the additional requirement under Code § 6055You may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form(s) as a part of your personal tax filing Your employer generally is required to distribute your Form 1095C by January 31st, covering information for the previous calendar yearWhen determining the Premium Tax Credit on a tax return, the taxpayer must reconcile the amounts reported on Form 1095A, Health Insurance Marketplace Statement by filing Form 62, Net Premium Tax Credit with their tax return However the amounts reported on Form 62 will be affected if the underlying health care policy was shared by more than one taxpayer

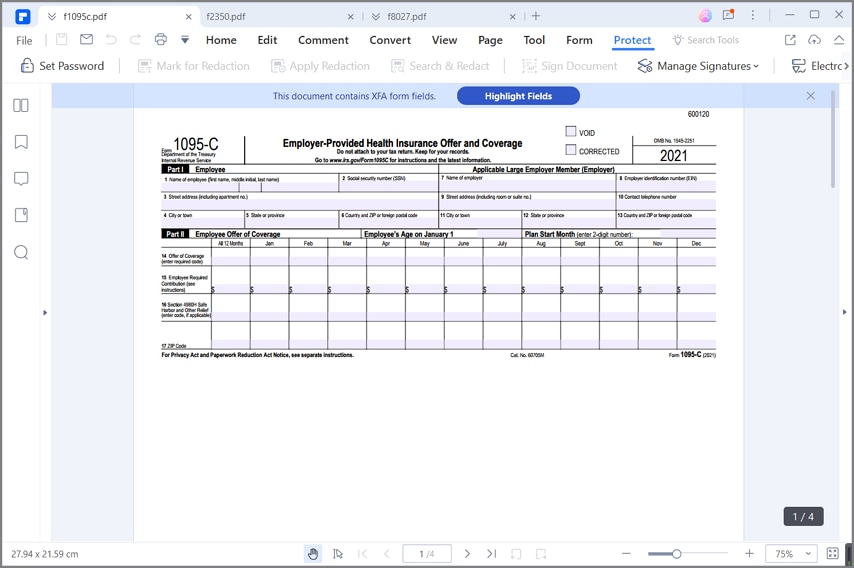

Fill out a PDF sample here, make needed edits, sign it and send instantly 21 1095c Template 21 1095c Template Form 1095C Get You may print out the Form 1095C and fill it out by hand Then make two copies to submit to your local IRS agency and to the employeeDec 15, 15 · 15 marks the first year applicable organizations are required by law to file Forms 1094C and 1095C As a result, many employers have spent the bulk of their time huddled away in offices learning the ins and outs of each form to ensure yearend filings meet the Internal Revenue Service's requirements (IRS)Oct 19, · On October 15, the IRS finally released its draft instructions for the Forms 1094C and 1095C While we knew substantial changes were coming to the instructions as a result of Individual Coverage HRAs (ICHRAs), the IRS also made changes that will impact every employer required to file the Forms As a result of most employers not offering ICHRAs and for simplicity

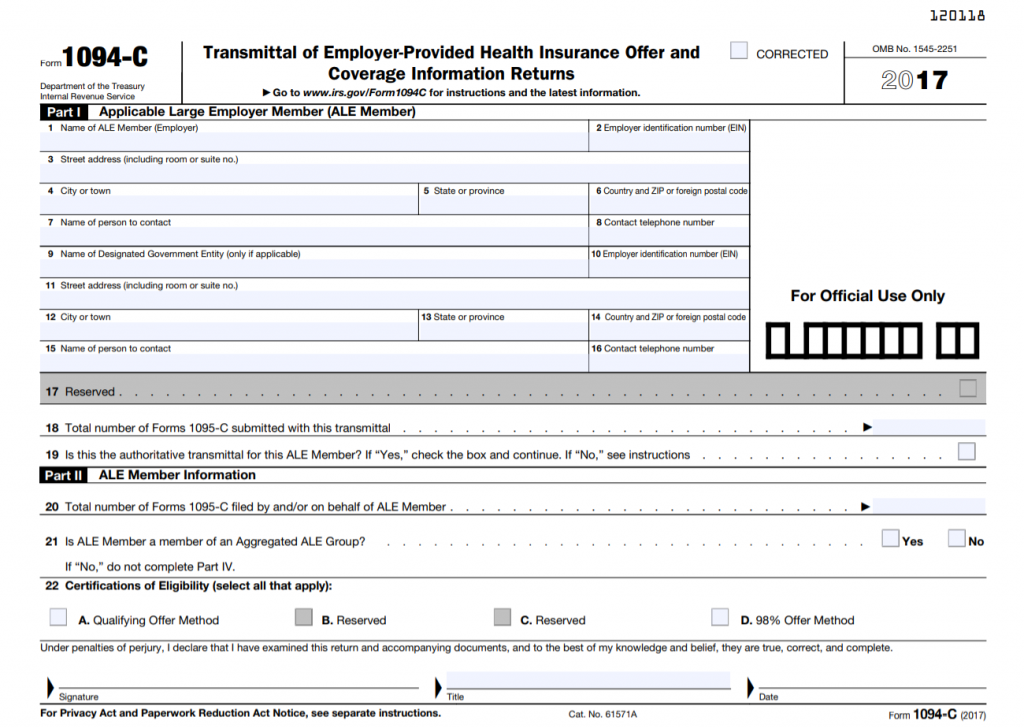

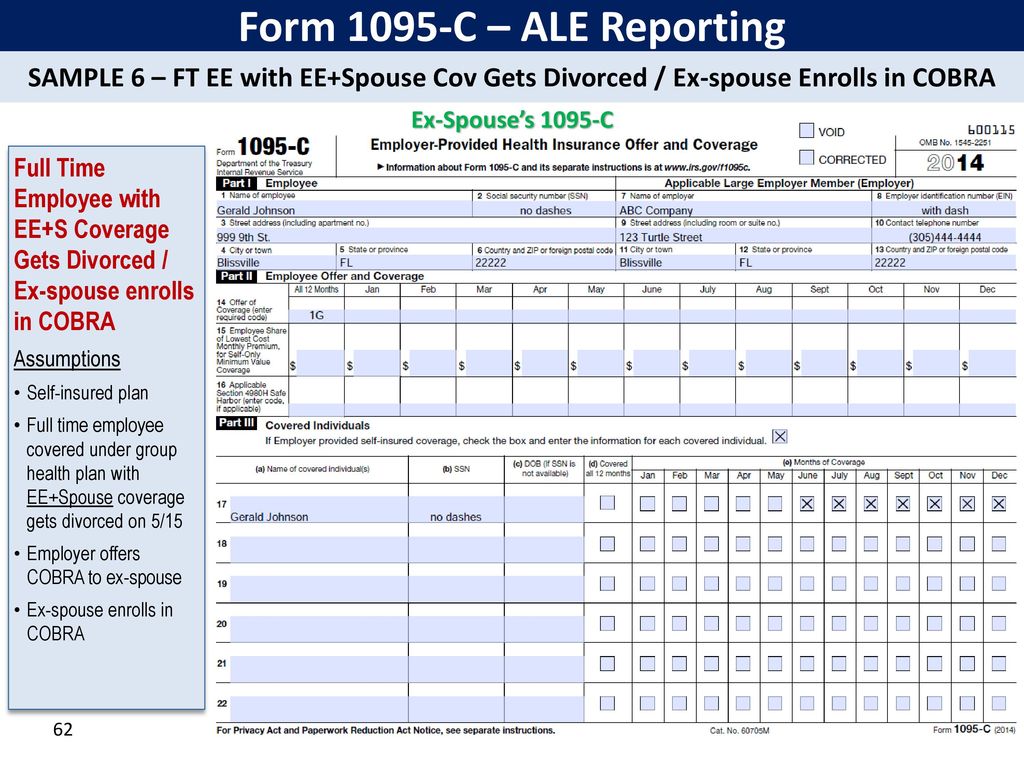

Jan 07, 21 · In filling this form, it is important to note that the best solution is PDFelement filler program This program allows you to fill out the form easily and very fast You can check boxes, radio buttons and type on your Form 1095C without problems This is particularly very useful as the form 1095C contains a lot of checkboxesOct 03, 18 · Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 18Feb 09, 15 · Every time you sit down to fill out a Form 1094C you have to ask yourself a fundamental question 78 79 Are all of my Form 1095Cs attached to this Form 1094C?

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

If any person on the tax return (Taxpayer, Spouse or any dependent) was covered by a Marketplace plan, they will receive a Form 1095A (Health Insurance Marketplace Statement) This Form 1095A comes directly from the federal Marketplace or a state exchange and should be issued to the Policyholder by January 31 The information contained on a 1095A is used to reconcile the NetDec 30, 15 · In part one you will fill out the employee name, SSN (including the dashes), and address Make sure the employee address goes in 16 Employer info goes in lines 713 This needs to match the 1094C information In line 7 it is asking for the legal entity that employs the particular person you are submitting the 1095C for If you have threeIt's tax season your favorite time of year for filling out a million forms, staring at your computer for hours, and maybe pulling out your hair just a bit But, reporting doesn't have to be stressful To file your Form 1094C and Form 1095C, just take it one step at a time

1095 A Form Fill Out And Sign Printable Pdf Template Signnow

Annual Health Care Coverage Statements

The forms are very similar The main difference is who sends the form to you The entity that provides you with health insurance will be responsible for sending a Form 1095Mar 12, 15 · Here are a few more questions from our webinar, "Mastering 1095C Forms for ACA Compliance" If you missed the webinar, you can replay it hereThese questions cover measurement and stability periods, Union questions, waiting periods, and specifics on the formsMar 23, 21 · Form 1095C –Individuals who enroll in health insurance through their employers will receive this form If you got any of the forms identified above, do not throw them away The 1095 Forms serve as proof of qualifying health coverage during the tax year reported Who Gets a Form 1095B Who will get his or her own Form 1095B?

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Jun 07, 19 · Edited If you have a 1095C, a form titled EmployerProvided Health Insurance Offer and Coverage the IRS does NOT need any details from this form You can keep any 1095C forms you get from your employer for your records When you come to the question "Did you have health insurance coverage in 15", simply select "Yes"Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out by theHow to fill out Obama Care forms 62 Premium Tax Credit if you are Single You will need your 1095A health insurance marketplace statement , 1040, 1040 sched

Fillable 1095c Fill Online Printable Fillable Blank Pdffiller

Fillable Online Employee Phoenix Sample 1095 C Form Employee Phoenix Fax Email Print Pdffiller

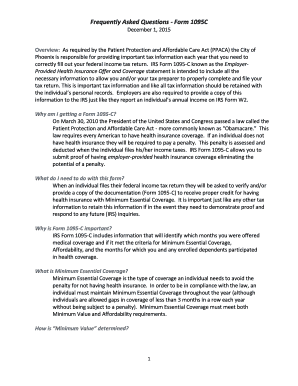

Feb 24, · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered toChoose File > Export > 1095C Data to open the Export 1095C Data screen;

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Control Files And Sample Forms

Jan 21, 16 · NC Department of Health and Human Services 01 Mail Service Center Raleigh, NC Customer Service Center For COVID19 questions call 1Form 1095C is used by qualifying employers with 50 or more fulltime employees (including fulltime equivalents) that are subject to the employer responsibility provisions of the ACA Form 1095C contains information about the offer of health insurance coverage to employees and their•IRS Form 1095C has a VOID checkbox (Not found on Form 1094C) •There is no reference to how to use this in the IRS instructions •Until further guidance is provided, if you want to "void" a previously transmitted 1095C, you should submit a "Corrected" form with Part II stating the employee was ineligible for all 12 months

Code Series 1 For Form 1095 C Line 14

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Sep 30, 18 · In addition, you will receive 1095B from the insurance provider and 1095C from your company Your insurance provider offers you a 1095A blank The webbased health exchange insurance company gives you the form 1095A form 1095a sample By wwwatrorg 17 Form IRS 1095 A Fill Online, Printable, Fillable, Blank By 1095apdffillercomLet's Look At The Most Common 1095C Coverage ScenariosForm 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax return

1094 C 1095 C Software 599 1095 C Software

Free 1095 C Resource Employee Faqs Yarber Creative

Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employeeForm 1095C is a new form designed by the IRS to collect information about applicable large employers and the group health coverage, if any, they offer to their fulltime employees Employers will provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittalDec 14, 15 · Line 19 When you fill out this form, determine whether you have all of the corresponding 1095Cs attached If yes, check this box If no, don't check this box If yes, continue If you realize after filing your 1094C and 1095C that you missed a 1095C, submit that one with its own 1094C, but don't check this box

Irs Form 1095 C Fauquier County Va

Pro Ware Llc Aca 1095 Reporting

Jun 04, 19 · If you did not have marketplace insurance and you did not receive a 1095A then you likely don't have to fill out the 62 (actually TurboTax does it for you when you enter the 1095A) But if you received a letter from the IRS asking for a 62, it's because their records show that you were on a marketplace policyChec k out our Form 1095C Decoder View Our Sample Form 1095C What is the difference between a 1095A, 1095B, and 1095C?Mark the checkbox for each client for which you want to export a template spreadsheet If necessary, click the Ellipsis button in the Client Options column to specify filtering and sorting options for the employees Click OK when finished

Accurate 1095 C Forms Reporting A Primer Integrity Data

1095 C Eemployers Solutions Inc

According to the IRS, as long as an employer obtains prior consent (electronically), the employer can distribute forms 1095C to employees through email or other other electronic method Sample MeasurementFeb 03, 15 · Fully complete only Parts I and III for each nonfulltime employee covered under the selfinsured plan (and only complete Line 14 of Part II) Forms 1095C must be filed with the IRS by March 31 (if filing electronically) A copy of Form 1095C must be furnished to the individual fulltime employee by January 311095c for dummies Fill out blanks electronically working with PDF or Word format Make them reusable by creating templates, include and complete fillable fields Approve documents by using a legal electronic signature and share them by way of email, fax or print them out Save forms on your laptop or mobile device

Form 1095 A 1095 B 1095 C And Instructions

Irs Form 62 Calculate Your Premium Tax Credit Ptc Smartasset

Mar 09, 15 · In a recent webinar on mastering ACA 1095C forms, we found out just how many questions our attendees had about this new and complicated process, especially as it relates to COBRA retirees Below we have addressed some of the most common COBRA retiree 1095C form questions Are we responsible for reporting COBRA coverage when it is outsourced?John Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning CirclePlease fill out this form, and we will email you a copy 1094C Save a Tree – Send your 1095C via Email to your Employees!

Form 1095 A 1095 B 1095 C And Instructions

Aca Code Cheatsheet

How to complete Form 1095C In order to stay compliant with the Affordable Care Act in 16, companies with a fulltime staff of 50 or more will need to file a Form 1095C for each employee We'll help you figure out how it worksThe deadlines for filing Form 1095C with the IRS and furnishing copies to the recipient are as follows March 2, 21, is the deadline to distribute recipient copies March 1, 21, is the deadline to paper file Forms 1095C with the IRS March 31, 21, isForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Questions Employees Might Ask About 1095 C Forms Bernieportal

Sample 1095 C Forms Aca Track Support

Aca Reporting Penalties Abd Insurance Financial Services

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

1095 B 1095 C ts Test Scenarios

F O R M 1 0 9 5 C E X A M P L E S Zonealarm Results

Import 1095 C Data With Expressirsforms Custom Template

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Ez1095 Software How To Print Form 1095 C And 1094 C

Tax Forms Bfi Printing Mailing Services Inc

Sample 1095 C Forms Aca Track Support

Form 1095 C Guide For Employees Contact Us

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

How To Fill Out Forms 1094 C 1095 C Employer Health Coverage Youtube

1095 C Software 1095 C Software To Create Print And E File Irs Form 1095 C

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Sample 1095 C Forms Aca Track Support

Affordable Care Act 1 Properly Reporting Cobra Continuation Coverage Integrity Data

Filing Aca Form 1095 C Is Easy With Ez1095 Software For School Administrators Newswire

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Irs Form 1095 C The Best Way To Fill It Out

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Aca Code Cheatsheet

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Ez1095 Software How To Correct 1095 C And 1094 C Form

Sample Print Of 1095 B And 1095 C 1095 Software

Irs Form 62 Calculate Your Premium Tax Credit Ptc Smartasset

Common 1095 C Coverage Scenarios With Examples Boomtax

1095 C Print Mail s

Print And Fill In 1095 C Fillable Form In 100 Free Cocosign

Ez1095 Software Speeds Up 1095 C Filing With Quick Data Uploading Feature Newswire

Pro Ware Llc Aca 1095 Reporting

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Sample 1095 C Forms Aca Track Support

1094 B 1095 B Software 599 1095 B Software

Form 1095 A 1095 B 1095 C And Instructions

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

Sample 1095 C Forms Aca Track Support

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Irs Form 1095 C The Best Way To Fill It Out

Form 1095 C The Aca Times

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

1094 C 1095 C Software 599 1095 C Software

Fillable 1095c Fill Online Printable Fillable Blank Pdffiller

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

1095 C Form Official Irs Version Discount Tax Forms

Think 14 Tax Forms Are Bad Here Come The 1094 And 1095 For 15 Aeis Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Sample Of 1095 C

1095 C Sample Hcm 401 K Human Resources

Control Tables And Sample Forms

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Guide To Correcting Aca Reporting Mistakes Onedigital

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

What Payroll Information Prints On Form 1095 C To Employees

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Aca Reporting Tip 16 Line 16 Union Employees Usi Insurance Services

0 件のコメント:

コメントを投稿